We have established a

winning strategy in Web3

Investing simply with us in FIAT, is investing without complexity in the Web3 space, in the best it has to offer for growing your wealth, safely!

See More

From Digital Assets to Impact Investment

Discover our range of eligible ESG Web3 products.

Combining Bitcoin with downside risk protection.

tokenized bond solutions.

Explore our stable coin solutions.

Support Web3 impact investments.

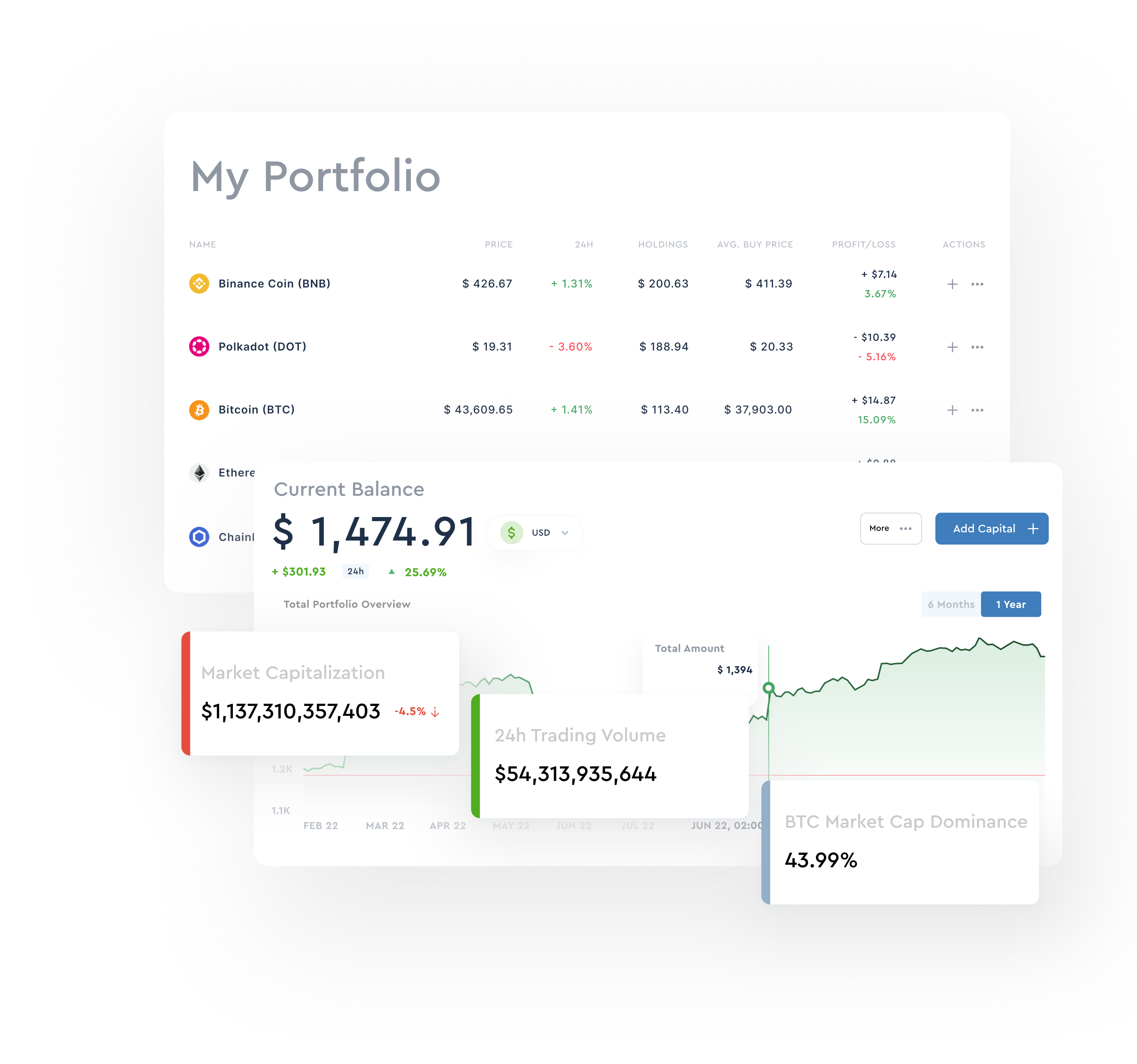

Personalised Investment Strategy

Select a personalized assortment of digital assets strategies that align with your preferences.

Guaranteed Safety

Committed to maintain strict security standards as tier-1 regulated bank. Including Risk Assessment Metrics for each counterpart we are operating with.

Comparison Chart

Features

Stable Growth Taking

TradeTogether Bitcoin Advantage Fund

SMA and Digital Bond Fund

| Features | Stable Growth Staking | TradeTogether Bitcoin Advantage Fund | Tokenized Bonds, Impact RWAs, Green Bonds |

|---|---|---|---|

| Risk Appetite level | Low risk | Low to medium risk | Low to medium risk |

| Locking period | No Locking period | 3 Months | 3 to 9 Months |

| Targeted Net Yields | 5.5 to 8% | Subject to upside | 8 to 14% |

| Minimum Investment | 5000 SGD | 5000 SGD | 5000 SGD |

We’re thrilled to offer you a web3 Fund vehicle On Demand also called ‘’Separated Managed account’’ SMA. Our expertise allows us to assess new types of Digital Assets or projects, ranging from Utility tokens, Tokenized Bonds and Web3 Impact investment projects.

Comparison Chart

Risk Appetite level:Low risk

Locking Period:No Locking Period

Targeted Net Yields:5.5 to 8%

Minimum Investment:5000 SGD

Risk Appetite level:Low to medium risk

Targeted Net Yields:3 Months

Token Basket:Subject to upside

Minimum Investment:5000 SGD

Risk Appetite level:Low to medium risk

Targeted Net Yields:3 to 9 months

Token Basket:8 to 14%

Minimum Investment:5000 SGD

We’re thrilled to offer you a web3 Fund vehicle On Demand also called ‘’Separated Managed account’’ SMA. Our expertise allows us to assess new types of Digital Assets or projects, ranging from Utility tokens, Tokenized Bonds and Web3 Impact investment projects.

Products

Stable Growth Staking

Our Benchmark Fund vehicle operating as the first of its kind Web3 Fixed income fund since 2021. Invested at 100% with Qualitative Stablecoins, risk assessed and traceable yield.

TradeTogether Bitcoin Advantage Fund

The Fund seeks exposure to BTC price movement while prioritizing downside risk protection and potential upside appreciation. Safeguarded by renowned crypto asset custodians, it offers a secure and accessible investment avenue.

Tokenized Bonds, Impact RWAs, Green Bonds

This category offers a range of web3 solutions tailored for Investors willing to diversify their portfolio with Tokenized Assets, ESG Driven Web3 projects and Sustainable investments (Impact Investments).

Fees

Transparency is our core value

Fees to actively optimise your portfolio

Blockchain fees for placing your capital

Web3 Risk Assessment and Project guidance

Fee-taking only on the profit generated

Frequently Asked Questions

Everything you need to know about TradeTogether

To get started, please specify your risk profile and investment objectives in the designated section. Using this information, our team will regularly recommend Web3 products that align with your unique financial profile. You can then choose from these recommendations based on your interests.

Management Fee on Investments:

- On each investment, we charge a management fee ranging from 1% to 1.1% upfront. The specific percentage depends on the Web3 product selected. This fee is utilized to cover our operating costs and ensure the continued delivery of high-quality services. It is important to note that we do not impose any additional fees based on the performance of the investment product.

- For our advisory services related to Curated Web3 solutions, we may charge fees of up to 3%. This fee accounts for the personalized advice and curated solutions provided by our expert team. It reflects our commitment to delivering tailored strategies that align with your financial goals and preferences.

We believe in transparency and strive to provide value that justifies our fee structure. If you have any specific questions about fees or would like further clarification, please don’t hesitate to reach out to our dedicated support team ( advisory@tradetogether.com ). We are here to ensure that you have a clear understanding of our fees and the services you receive.

It’s important to note that while Stable Growth Staking provides a stable option, some of our offerings categorized as High Risk naturally carry higher levels of risk. For instance, an AA tokenized asset class will inherently have less risk compared to a Tokenized Credit Debt, making it a more stable Web3 investment option.

Our commitment is to empower investors with a diverse range of opportunities while providing clear insights into the risk profiles associated with each product. If you have any specific questions or need further clarification, our dedicated customer service team ( advisory@tradetogether.com ) is here to assist you.

Tailored to your

risk appetite

You don’t have to go with only one fund or the other. We can create a specific allocation of your capital between our pocket funds. Based on your goals and your risk profile, we will recommend you a bespoke investment strategy.

Safety First

We apply the same strict security standards as tier-1 regulated banks, equivalent to ISO/IEC 27001.

Assets segregated with tiers 1 Custody solutions.

On/off Ramp enabled with tiers 1 Regulated Banks.

Transparent fee application

KYC Implementation with reputable trusted partners

Join a new generation of investors

Get Started On TradeTogether

Give your money a chance to invest safely, in Web3, and join tradetogether Investor community, right now!

View Full Chart On Web

View Full Chart On Web